What should we take away from this year’s Budget? Our PEF Council react to Hammond’s announcements on Universal Credit, investment, growth and more below. For more progressive perspectives on the Budget, tune into our new podcast on SoundCloud.

Guy Standing: “Universal Credit is cruelty in action”

There are many aspects of this budget that should cause disquiet. I want here to concentrate on two – the freezing of fuel duty and the sprinkling of extra money on the wildly misnamed Universal Credit, the means-tested (i.e. non-universal) social assistance flagship of the Tories and Liberal Democrats.

What Hammond has done is provide about £2.7 billion more to prop up Universal Credit, mainly putting the money at the wrong end of the policy, increasing the amount of money a claimant can earn from a job before losing the benefit. What he should have done is tend to the truly disastrous top end of the policy, and the government should have put a halt to the roll-out, whereby up to seven million people will be enmeshed in the system. It is probably the worst social policy since the workhouse.

The disgrace starts with the fact that claimants have to wait five weeks before they can claim the benefit, and because of well-established delays many have to wait for three months. Iain Duncan Smith, the architect of the policy, said repeatedly that he wanted Universal Credit to be as close to being in a job as possible, which is why all sorts of arbitrary practices are imposed on claimants, such as reporting for numerous interviews, proving they are spending virtually all their time looking for jobs and so on. Well, I am sure Mr. Duncan Smith would never take a job that did not pay him from day one. He would regard it as ridiculous and unfair if told he would not be paid for the first two months. That is what the scheme imposes. And surprise, surprise, huge numbers of people are falling into free-fall debt and worse. Where Universal Credit has been rolled out, homelessness has increased more than elsewhere, resort to food banks has soared, and suicides have gone up. Mr Hammond in a pre-budget TV interview smugly said: “There are no unemployed in Britain.” It was nonsense, of course, but one reason for unemployment being low is that thousands of people have either become too sick to be counted or have drifted into the streets and out of the labour force altogether.

Universal Credit should be stopped, and a full-scale independent enquiry into its inequities should be launched. The heavy-handed use of sanctions is denying huge numbers of people benefits to which they are legally entitled. There is no respect at all for basic principles of due process; arbitrary denials of livelihoods are rife. A high percentage of those denied who appeal are eventually shown to have been falsely denied benefits. But the appeal process takes many months, leaving them drifting into destitution in the interim. If they do obtain a measly ‘loan’ from the Department of Work and Pensions, that is then deducted from any benefits they start to receive. It is cruelty in action.

The other policy I wish to highlight is the freezing of fuel duty for the ninth year in a row. The Chancellor crowed that he was continuing to protect the car driver. Well, his action came just weeks after the Inter-governmental Panel on Climate Change (IPCC) delivered a devastating report warning that we are drifting into ecological disaster due, in large part, to carbon emissions. Unless drastic action is taken to curb use of fossil fuels, primarily in transport, that disaster will come closer. There is no social or environmental excuse for freezing fuel duty. Our children and grandchildren will be those who mainly pay the price.

Stephany Griffith-Jones: “The Chancellor offers a small plaster for large wounds”

Levels of investment in UK are one of the lowest amongst the OECD countries, which worsens prospects of future increases in productivity and expansion of economic activity.

It is therefore a source of concern that the Chancellor has offered peanuts to compensate for the loss of finance for investment, which leaving the European Investment Bank (EIB) will mean. The EIB lent £ 5.5 billion to UK in 2016. The Chancellor offered only £200 million via the British Business Bank to compensate for that! UK will lose almost 30 times that by leaving the EIB. Typical of this Chancellor to offer a small plaster for large wounds – that is clearly insufficient!

Sue Konzelmann: DoPYE… Don’t Pay If You Earn

Philip Hammond’s budget demonstrates a very strange approach to taxation: Tax arrangements become more favourable, the more you earn.

His £3bn budget giveaway offered those earning £12,500 a windfall of around a tenner a month. If that amount does, as claimed, make a critical difference, it strongly suggests that many of us are far closer to the edge than we should be. For higher rate tax payers though, the benefit is more noticeable – something approximating to the cost of a nice weekend away, perhaps. Even though this will include quite a few of his MPs, it’s probably still unlikely to help unite a fractious party – or indeed to make him any more popular with lower income earners.

It should come as no surprise, then, that the “groundbreaking” Tech Platform tax isn’t quite all it might seem, either. It’s predicted to raise some £400m annually, which is certainly not a bad thing from the perspective of other British retailers. But what about corporation tax?

According to the BBC’s Simon Gompertz, Google declared a turnover of just over £1bn in the UK for the last financial year to the HMRC. However, the latest accounts filed in the US by Alphabet, Google’s parent company, “show UK sales of more than £6bn”. This discrepancy is made possible by the complex accounting and tax options available to multinationals: In this case, according to Bloomberg, the rather unappetising sounding duo of the “Double Irish” and the “Dutch Sandwich”, which involves shuttling funds between the Irish Republic and Holland – and then back again. It is also worth noting that all three economies – Ireland, Holland and the UK – are (for now, at least) EU members; so it is apparently not only the UK that has failed to act so far.

At least, though, Philip Hammond can take comfort from the even more questionable approach taken by his predecessor, George Osborne. Osborne’s much vaunted “victory” over Google’s unpaid taxes between 2005 and 2014 was meant to net the HMRC £130m, although corporate accounts show that they actually had to settle for less than £100m. However, it was made to look rather less convincing by an analysis by Reuters news agency. This concluded that, based on Google’s US filings over that period – of £24bn – its tax bill should actually have been around £2bn (rather than £130m). Now that really is a tax giveaway!

That one corporate tax giveaway amounted to almost two thirds of the cost of yesterday’s tax cuts for UK residents – and it probably wasn’t the only one, either. There can be few better demonstrations as to how wrong the priorities of the last two governments have been – and apparently remain. DoPYE indeed.

Geoff Tily: “The Chancellor wants you to think that the Budget was good for working people. It wasn’t.”

The Chancellor claimed that his extra spending was down to the success of austerity. In fact it was an admission of its failure, because the logic of his argument was that spending strengthens the economy and boosts the public sector finances – the very opposite of austerity.

That’s why austerity is a false economy. Over the last eight years, the policies of austerity have vandalised public services, damaged growth and reduced the deficit at a snail’s pace.

That’s why reversing austerity is the right policy. Spending when the economy is weak would have repaired the public finances quicker. And the strength of public services goes hand in hand with the strength of the economy.

For workers this is all far too little far too late. According to the OBR, any improved outlook for growth will lead to more jobs, but do nothing for real wages. The Chancellor attempted to soften the blow on wages with changes to tax thresholds amounting to £130 a year for most workers, but this hardly compensates for wages in 2018, which are down £26 a week or £1350 a year on the pre-crisis peak.

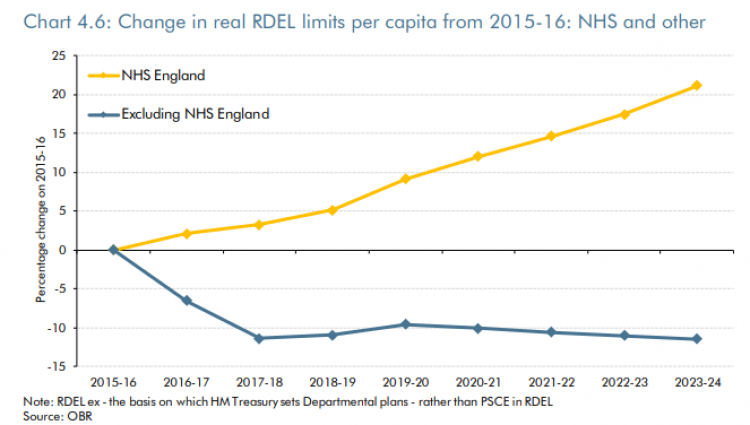

On public services, cuts across the public sector remain firmly in place outside the NHS, as the OBR’s chart on real departmental spending (‘RDEL’) per head shows:

While health spending is set to rise, severe cuts to all other public sector spending will remain in place. This is very far from ending austerity – and the 2015 starting point in the chart above omits the brutality of the cuts imposed by Hammond’s predecessor in the previous five years. Analysis by the New Economics Foundation suggests that there will still be cuts of almost £3.5bn (5.2%) to unprotected budgets after 2020. Even in departments with excepted protections there will be cuts per head, for example on schools – assuming protection is maintained in real terms the schools funding announced at the budget yesterday will still amount to a 2.6% cut per pupil.

It’s clear that both workers and public services will continue to be pummelled by austerity policies for years to come. But it doesn’t have to be this way.

The OBR continues to apply the logic of the household budget, keeping improvements in the economy separate from changes in the public finances. But managing national finances is not the same as managing a household Budget. It’s about time that the OBR and the government acknowledged this and increased public spending accordingly to set the economy on the right track.

In the meantime, austerity continues. How much longer must workers wait for it to end?

This comment is an adaption of a longer post. For the full analysis, see Geoff’s post on the TUC website.

John Weeks: “Forecast growth for 2019-2022 would be the slowest four year average since 2008”

For Mr Hammond, Brexit provides an excuse that keeps on excusing, but he now has dropped it, at least temporarily. A week ago he “cautioned” that not reaching an EU agreement would undermine his budget plans. Yesterday the caution turned to a warning. Whether by convenience or intelligence he now drops that lame excuse. He kept it in his back pocket, though, by basing his budget on the prospect of a favoured agreement, which would produce a “double Brexit dividend”

Down-playing the Brexit excuse provided the vehicle for the Chancellor to repeat his prime minster’s claim of austerity “coming to an end”, which neither linguistically nor practically implies an imminent termination of the disastrous policy.

Mr Hammond went into his Budget with the lowest annual public sector borrowing for any fiscal year since 2001, only £26 billion or 1.3% of GDP for the 12 months through this September (ONS Public Sector Finances, Tables 2 and 5b). In response to these numbers, Mr Hammond betrayed his ingrained ideology with a list of true-blue austerity qualifications:

- additional NHS spending is conditional on “reforms”, a Tory code word for staff reductions and privatisation; and

- funding increases for local councils, schools, social care and mental health barely exceed expected inflation.

Perhaps the most revealing moment of Mr Hammond’s underlying ideology came with his attack on the Labour Party, accusing it of being prone to “reckless spending”, which he assured his listeners caused the global crash of 2008 (“Labour’s recession”).

In that context his austere predilections came clearest in his passing reference to OBR projections for economic growth. His party has held government for over eight years. OBR growth projections for 2019-2022 average below 1.5%, which if realized would be the slowest four year average since the global collapse of 2008. The Chancellor does not mention that this dismal growth performance will be the direct result of austerity policies.

That forecast of near economic stagnation under the Tory government prompts a paraphrase of Cassius in Julius Caesar (Act 1, scene 2, lines 140-141), “The fault, dear Hammond, lies not in your Brexit but in yourself, for you are an austerian”. Drop the obsession with balancing the overall budget and you clear the way to end austerity. The Tory chancellor will not do that. His counterpart on the opposition benches will.

Simon Wren-Lewis: “The Conservatives are trying to reduce the level of debt to GDP by too much prematurely – that does not make sense”

A few things you probably won’t read about what the Chancellor announced yesterday. You will have read that the budget measures as a whole amount to a significant fiscal giveaway. In which case the following chart may appear surprising.

Negative numbers represent a current budget surplus, and growing surpluses are a fiscal tightening. You can see that with the exception of this fiscal year, when policy is tighter, the current balance profile of rising surpluses has not changed very much. The reason for this apparent contradiction is simple enough. If nothing had been done, the higher taxes than forecast represents a significant fiscal tightening compared to previous expectations, albeit a tightening that represents forecast error rather than policy decisions.[1] What the Chancellor did yesterday from next year onwards is restore the policy stance to what it was before the forecast error was discovered.

What this means is that the Chancellor has kept his path of modest fiscal tightening over the next five years, As I have said many times, this is simply not appropriate in a situation where interest rates are close to their lower bound and the immediate outlook is highly uncertain. But then this government has never understood about monetary and fiscal coordination.

Labour’s fiscal credibility rule (FCR) allows us to see how differently a Labour government would run the non-investment part of fiscal policy. The FCR requires the government to aim for current balance in 5 years’ time. That, of course, is zero on this chart. That tells you that, if this is indeed the path the current balance follows, Labour will have extra spending or lower taxes than the Conservatives worth over 1% of GDP. That covers the gap the IFS suggested in their costings from the 2017 manifesto with plenty left over.

As I have already suggested, Labour’s overall fiscal stance if they stick to the FCR makes a lot more sense. The Conservatives are trying to reduce the level of debt to GDP by too much prematurely. That does not make sense from a precautionary Keynesian point of view, or from a simple tax/consumption smoothing point of view. But macroeconomics remains an excluded consideration from Conservative/Treasury budgets, and ‘mediamacro’ pretends the government is just like a household that needs to pay off its debts within its lifetime.

This comment is cross-posted from Simon’s blog ‘mainly macro’.

[1] Suppose the forecast error was X. Then imagine that error had not occurred, but the Chancellor had raised taxes by X. The latter would clearly be a fiscal tightening by the Chancellor. But in macroeconomic terms taxes rise by X in each case, so the two are equivalent.

Photo credit from previous page: Blogtrepreneur/Flickr