One of the less well-publicised challenges to the UK economy from Brexit is the loss of investment funding for UK industry and infrastructure from the winding down of the European Investment Bank’s (EIB) British lending program. In 2016, the year of the referendum, the EIB lent €7 billion to 54 projects across the UK; by 2018, this had collapsed to €932 million. This casts into sharp relief Britain’s lack of a major publicly owned National Investment Bank, in contrast to most of our major industrial competitors.

In April 2019 the UK government announced an increase in the British Business Bank’s funding by £200 million, with the apparent purpose of replacing the EIB funding. But in its current form, the BBB is incapable of lending at the scale of the EIB or any of the other major NIBs. In comparison, Labour Party plans for a National Investment Bank imply around £25 billion of lending and loan guarantees every year for 10 years. Such an institution might help plug the ‘patient finance’ gap that has afflicted the British economy for decades.

In a new guest paper for IIPP we outline the extent to which a National Investment Bank would affect the public debt and be affected by EU state aid rules — two important questions which have not been considered in depth.”

Public finances

As a future National Investment Bank will be owned by the government, it will — unsurprisingly — be classified as a public sector institution by the Office for National Statistics. As a result, its net debt will count towards the total public sector net debt. Given that the Bank’s assets will be relatively illiquid, this effectively means that the Bank’s lending will add around £25 billion to the public sector net debt every year.

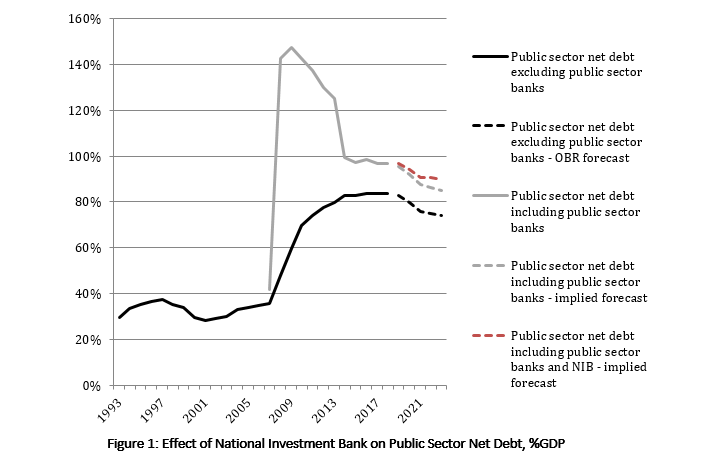

This addition to the public sector debt, however, is unlikely to pose a serious problem. There are two reasons for this. First, the ONS already publishes net debt figures including and excluding public sector banks, with the latter figure generally used as the baseline measure of public borrowing. As the National Investment Bank will almost certainly be classified as a public sector bank, its lending will therefore leave the baseline figure unaffected.

Second, an annual increment of £25 billion to the public sector net debt is actually a relatively small amount. This is illustrated in figure 1, which approximates the effect of a National Investment Bank on current OBR forecasts. The Bank’s liabilities total £125bn by the end of the 5 year forecast horizon, raising the 2023 forecast of public sector net debt from £2179bn to £2304bn — an increase of around 6%. As the OBR’s forecast for nominal GDP in 2023 is £2561bn, the 2023 forecast of public sector net debt as a percentage of GDP increases from 85% to 90%.

State aid rules

While the effects of a National Investment Bank on the public finances are relatively straightforward, its relationship to EU state aid rules is more complicated. These rules are intended to prevent governments from providing subsidies (including grants, interest and tax relief, guarantees, government holdings, etc.) to specific companies or sectors that could distort competition and affect trade in the single market.

At the level of broad generalities, current state aid rules do leave sufficient room for the UK to establish and operate a National Investment Bank. A number of member states already have large and active NIBs, including Germany, France, Italy and Spain. In the post-crisis environment, NIBs are seen by the European Commission as key partners for its Juncker Plan (2014–20), and future InvestEu plan (2021–27), and among large member states the UK is the exception in not having a serious National Investment Bank.

EU state aid rules do, however, limit the range of activities that NIBs can undertake. Broadly speaking, state aid rules allow NIBs to conduct horizontal industrial policies which claim to provide public goods that benefit all industries equally, but not vertical or selective ones that focus on promoting or upgrading specific sectors or firms. The General Block Exemption Regulation (GBER) designates a number of categories where horizontal aid is allowed, including for underdeveloped regions, SMEs, research and development and innovation, and environmental protection.

Fortunately, the distinction between horizontal and vertical industrial policies is not as problematic as it initially appears. In practice, as horizontal and vertical industrial policies are very hard to distinguish, many vertical policies can in fact be legally conducted under current horizontal state aid framework. For example, renewable energies can be promoted under the environment GBER, while advanced manufacturing sectors like aerospace can be promoted under the R&D and innovation GBER. If they do not fall under the GBERs, sector specific programs can still be compliant with state aid rules if they are notified and the EC agrees that there is a legitimate market failure.

What if a National Investment Bank does need to move beyond horizontal policy? We argue that this would be best achieved by remaining in the European Union. For example, a Labour government could call for progressive reform of state aid rules to allow for more targeted industrial policy, as well as a more flexible set of rules for less-developed member states to allow them to catch-up. Importantly, EU industrial policy itself is moving in a more openly vertical direction, with the German and French governments calling for amendments to the state subsidies and competition rules to enable them to create ‘European champions’. If the UK were to retain a special trading relationship with the EU after Brexit, it would need to abide by state aid rules in any case, but without having any influence in shaping them.

In summary, the financial and legal barriers to an ambitiously sized British NIB are not as challenging as might have been thought. Given this, whatever happens in regard to Brexit, it would seem the time is right to create such an institution to support British industry and help create a more investment-led growth model.

You can also read this post on the UCL IIPP blog here. You can read the ‘Financial and legal barriers to the creation and operation of a British national investment bank’ report at UCL IIPP here.

Photo credit: Flickr / TeaMeister.