The term “fiscal” comes from the Latin for “purse”. When it comes to fiscal policy – how the government manages the country’s budget – a lot of people wrongly compare the country’s purse, and how it’s managed, with that of an individual or household.

The government’s purse is like no other. Managed correctly, it can end austerity and make the economy both stable and fair.

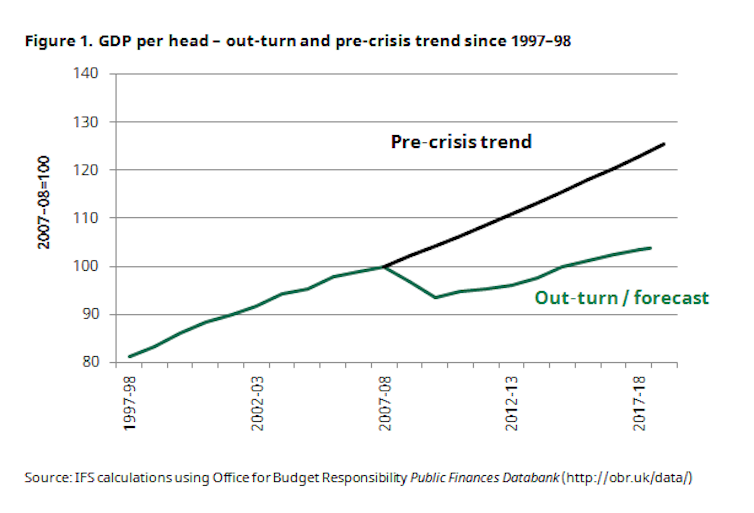

The UK economy initially showed a strong recovery from the 2008 financial crisis. It began in late 2009 and continued into 2010. Then, eight years of austerity policies by Conservative governments ended the recovery and brought recession, stagnation and growing poverty. Excuses offered by Conservative politicians, from world market instability to Brexit anxieties, fail to conceal the real cause of this dismal post-crash economic performance.

The Conservative government suffers from “deficit fetishism” – where all public policy is held captive to hitting a fiscal balance of zero (or going into surplus) by means of expenditure cuts. But the huge cuts to public spending have repeatedly failed to achieve a balanced budget. Nevertheless, much of the British public remains gripped by the dysfunctional fiscal goal of deficit reduction.

Britain’s woeful recovery from the financial crisis. IFS

Britain’s woeful recovery from the financial crisis. IFSBasic problems

A basic problem with budget balancing in all its versions is the improbability of achieving it. Take the example of a deficit, a negative budget balance, and a chancellor committed to reducing the deficit quickly. This chancellor believes the way to reduce the deficit is to increase taxes or reduce spending. Conservative chancellors since 2010 have preferred spending cuts.

But spending cuts reduce the demand for goods and services bought by the public sector, such as medicines and medical equipment. As a result the companies that supply these goods and services reduce the number of people they hire and lower their investment. These declines result in a fall in corporate and household incomes. Tax payments then decline. So any fall in the deficit and public borrowing will be less than the cuts themselves.

The repeated failures of Conservative governments to meet their fiscal targets since 2010 clearly demonstrates the effect of cuts to private incomes and spending. A budget balancing approach to fiscal policy reinforces the instability of Britain’s economy. When private spending is weak, budget balancing makes it weaker, magnifying small recessions into big ones. Economists call this “procyclical”.

Instead of the dysfunctional, procyclical budget balancing obsession, the chancellor should do the opposite – use fiscal policy to minimise the instability of the economy. Economists call this a “countercyclical” approach.

An enlightened chancellor will be well aware that falling tax revenue in a recession is a good thing. It leaves households with more spending power than otherwise would be the case. Of course, the falling revenue means a growing deficit (or a declining surplus). By leaving people with more after tax income, the deficit is not a problem, though, it is part of the solution.

Common sense

The guidelines for an active countercyclical fiscal policy are common sense: use public investment to stimulate medium and long-term growth. Meanwhile current spending provides the tool to keep the economy at a stable and high level of output and employment. The following principles will help the government end austerity and build a better economy.

- Public investment in things such as education and transport is the instrument to stimulate growth. This spending takes time to implement and see a return so projects should not be stopped half way through. It is not an efficient instrument for the short-term management of economic output and employment even though it is very effective in stimulating the economy.

- Adjusting current spending provides the tool to counteract the waxing and waning of private investment and exports that would otherwise cause inflationary pressures or recessional decline. For example, if the economy is in recession, an increase in pensions or a one-off bonus to public employees would prompt more household spending, which creates greater demand for private goods and services. If inflation threatens, the chancellor could introduce temporary tax increases to dampen private spending.

- The public budget may show a surplus or a deficit as a result of this kind of active fiscal policy. This depends primarily on the behaviour of the private sector. Vigorous private sector demand favours a fiscal surplus, while weak private spending implies a fiscal deficit. Either is fine.

- The balance between spending and taxation is the outcome of an active fiscal policy. That balance is not a policy goal in itself. The goal should be a progressive economy – where all who want jobs have them and those jobs come with decent pay and safe conditions, where public services thrive thanks to adequate funding, and economic benefits are distributed evenly across the country.

This article is part of our 100 Policies to End Austerity series, and is cross-posted from The Conversation.

Photo credit from previous page: Flickr / QuoteInspector.