New research, published today by the Progressive Economy Forum, shows that the widely- reported £50bn “hole” in the public finances, is the result of government accountancy rules and highly uncertain forecasts, not tax or spending decisions.

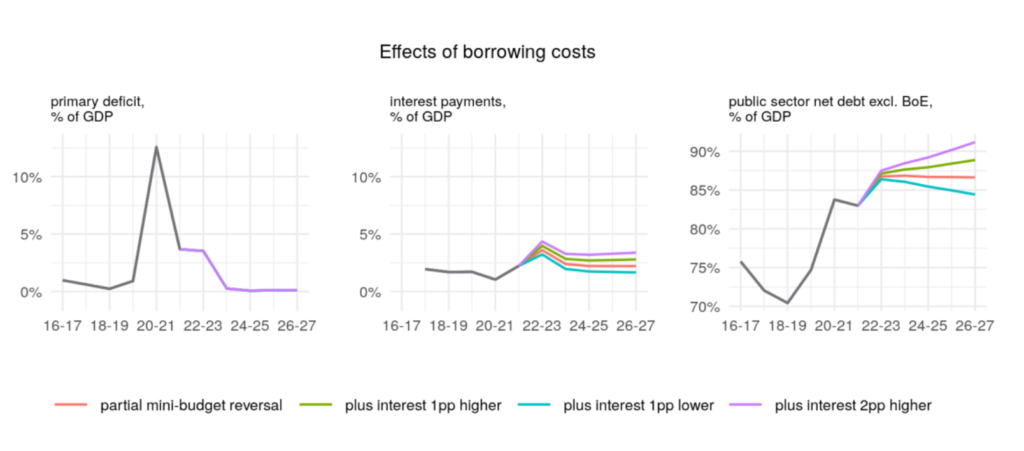

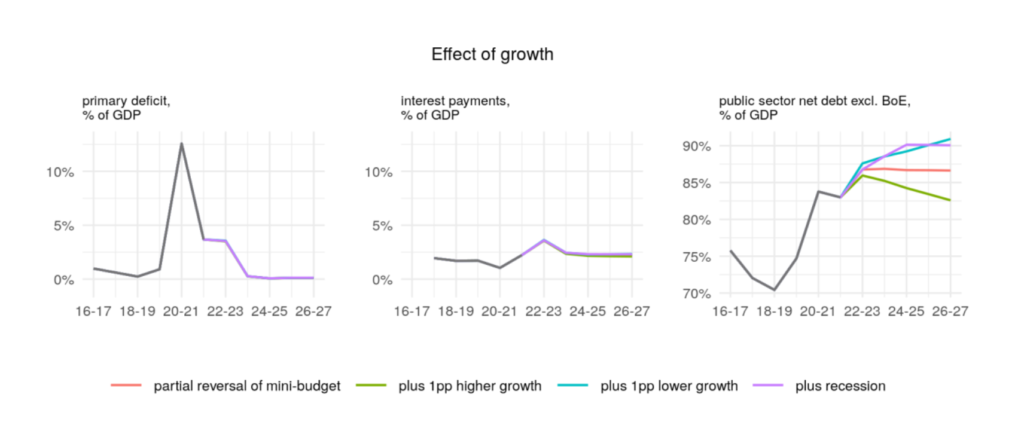

Using official forecasts from the Office for Budget Responsibility, economists Dr Jo Michell and Dr Rob Calvert Jump show that small changes in forecasts for future interest rates and growth, and what is counted as government debt, dramatically alter the size of the apparent “hole” in the public finances.

These changes to forecasts and accountancy rules produce hugely bigger effects than the £50bn or more changes in spending and taxes the government is reported to be considering for the Autumn Statement.

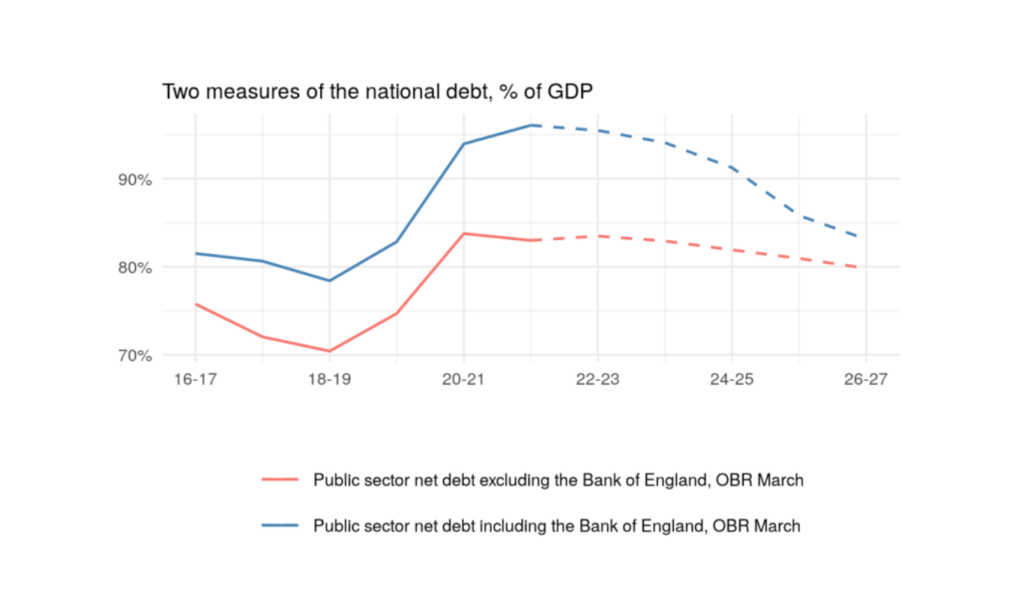

Most dramatically, reversing a decision to exclude the Bank of England’s debt from the government’s own debt figure, made in January 2022, completely wipes out the projected “fiscal hole” and, on the official forecasts, leaves the government with an additional £14bn to spend against its own debt targets by 2027.

Examples of minor changes, relative to the government’s current forecasts, are shown in the modelling results below.

1. A small increase in the government’s forecast borrowing costs makes the path of future debt unsustainable, making the target useless.

2. Slight changes in the forecast rate of growth, including a possible recession, mean the government also miss its target, also making the target useless.

3. Changing the accountancy rule used to measure the government debt back to what it was before Autumn Statement 2021 completely removes the “black hole”, putting government debt back on a sustainable footing with £64bn headroom to spare.

Picture credit flickr