The main rate of inflation in the UK, the Consumer Price Index, fell from July’s 40-year peak of 10.1% to 9.9% in August. This reflects the impact of sharp declines in the global price of oil over the summer, which fed into the falling price of motor fuel. However, food prices are continuing to rise, and the increasing price of food made the biggest single upwards contribution to the overall figure.

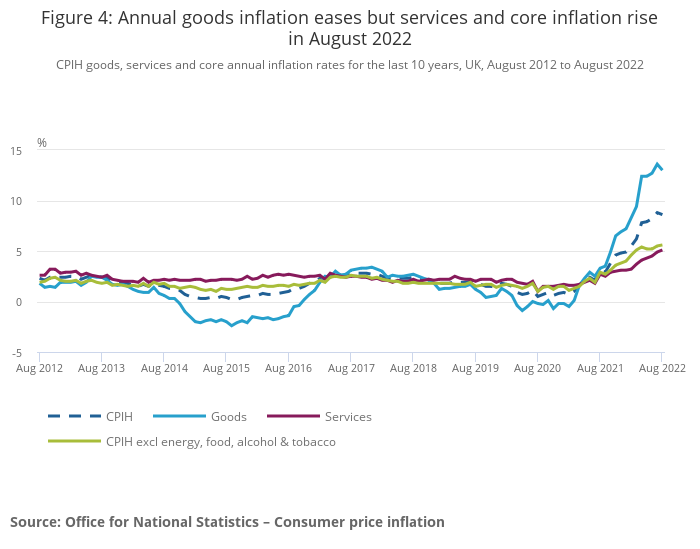

The graph below, from the Office for National Statistics, shows the impact – excluding food and energy price rises from the overall figure would bring the reported rate of inflation down by about 4%.

It’s worth stressing that this general picture is the same across the globe: the surge in oil and gas prices, pre-dating Russia’s invasion of Ukraine (see the graph below), and the very rapid rise in food prices are common everywhere. The graph below shows the same measure of inflation across the G7 economies. The common experience is obvious, although Britain is the worst-affected by the rise:

It’s likely, although not a given, that oil and gas prices will continue to fall over the next few months, easing pressure on inflation significantly. (Goldman Sachs has a particularly optimistic view of this, expecting natural gas prices to “tumble” across Europe in the next few months.) In the UK, the energy price cap, to be introduced by government to limit the October increase in typical domestic energy bills to £600 is forecast, by government, to take 4% off the expected rate of inflation over the end of the year. Some of the predictions of a 20% or even higher inflation rates look less likely to come true – though subject to substantial uncertainty, not least around events in and related to the Russia-Ukraine war.

But this doesn’t mean the great inflationary surge is over. Far from it. There are two points to bear in mind. First, inflation is cumulative. If the rate of inflation today is lower than it was last month, that doesn’t mean prices in general are falling. It means the overall rate of increase is less fast. Those higher price rises are likely to be permanent – prices went up 10.1% in the 12 months to July, and went up 9.2% in the twelve months to August. They’ve not actually fallen. Unless incomes from wages, salaries, benefits and pensions rise rapidly, those high particularly high prices earlier in the year will represent a permanent loss to most people’s living standards. And prices, bear in mind, are still rising.

Second, inflation is unlikely to settle back down to the 2% or so level it has been at for the last two or three decades. The reason for this has less to do with the explanations usually offered, around wages being too high (if only!) or there being too much money in the system. It has to do with the way in which our global, money-based economy responds to continued environmental shocks. Many economic activities are getting harder to undertake, as the environment we live in changes. Extreme weather events are becoming more common. Resources, whether mineral or agricultural, are depleting, pushing up prices. Recent shocks to the food supply include:

- South Africa’s biggest locust plague for 25 years attacked farms in the eastern part of the country in April 2022, following “Biblical” plagues across East Africa in 2020. The worsening outbreaks are thought to be linked to increasingly volatile weather conditions associated with climate change;

- The Environment Agency forecasts that extreme heat in 2022 is will reduce UK production of “carrots, onions, sugar beet, apples and hops” by 10-50%;

- Europe’s “worst drought for 500 years” is forecast to reduce output for maize by 16%, soybeans by 15%, and sunflowers by 12% compared to the average for the last five years.

Some of the impacts of climate change can be quite unexpected, like extreme heat drying out the Rhine and so restricting goods transport across Europe, pushing up the price. But whatever the source, or the specific impact, these environmental shocks keep happening, pushing up the real costs of economic activity. In a global economy dominated by credit money, this translates into rising inflation – increased costs becoming rising prices which then pull more money into circulation.

This has, notably, nothing to do with wages: in fact, faced with shocks like this, the best thing to do in the short term is insist wages must rise to compensate, with profits adjusting to carry the strain of reduced outputs and higher costs, rather wages and household incomes. Wealth, rather than household incomes, can act as a better short-term shock absorber and when British companies have over £950bn stashed in their bank accounts – up £500bn from 2010– there is no good reason to not put that money to better use. In the long term we need far more resilient energy, food, and transport systems – something likely to start with on-shoring production and the switch into renewables.